It’s the year you get your home reappraised. Great. It’s going to impact on your property taxes no matter how you slice it. It’s worth spending a couple hours putting together an appeal to potentially save thousands of dollars. We’ve done it, and the process is not as daunting as it may seem.

The most important thing to know about real estate tax is the appraised value is the key input. And it’s negotiable. The real estate tax calculation starts with the appraised value and multiplies that by the tax rate.

The appraised value is generally reassessed every other year. If there are any changes to the value you are sent a letter in the mail that shows the previous appraised value, new appraised value and comparable properties that were used to determine the new value.

The letter should also provide the process for filing an appeal. The process goes something like this: Initiate the appeal by the deadline, prepare your case, get a date to review your case with a real estate professional acting on behalf of the taxing authority, get the result.

On your day to present your case you will discuss your specific scenario with a real estate professional and a board that reviews the real estate professional’s recommendation based on your evidence. Your opportunity to sell your case lies with the real estate professional. He has an understanding of the market and will understand the facts you bring forward. You are the expert on your property. Remember that. Be succinct and focus on fact during that discussion.

Although every homeowner has ability to negotiate their home value, few do, and even fewer spend the time to do it correctly. Sometimes just showing effort saves you $, and having facts to back it up always saves you $. Put your facts in a word document and prepare to review them with the tax authority.

Below are five things to present to support your case.

- Comparable sales: You have the power to argue the comparables that were used are not valid and there are other comparables that should be used. First step is to search for recent home sales in your area that match the approximate size with similar beds/baths to your home. Once you get your new comps it’s critically important to focus on price/square foot. Multiply the average price/square foot by your square footage to get your new value projection. The best tool is Redfin.com to get comp price/square foot values. You can filter to sold homes in your zip code by the number of beds and baths and square footage. The coolest feature of Redfin is the table functionality, you can show all sold homes that meet your criteria, it will show you the price per square foot. The trick here is to pick comps that match your target price/square foot

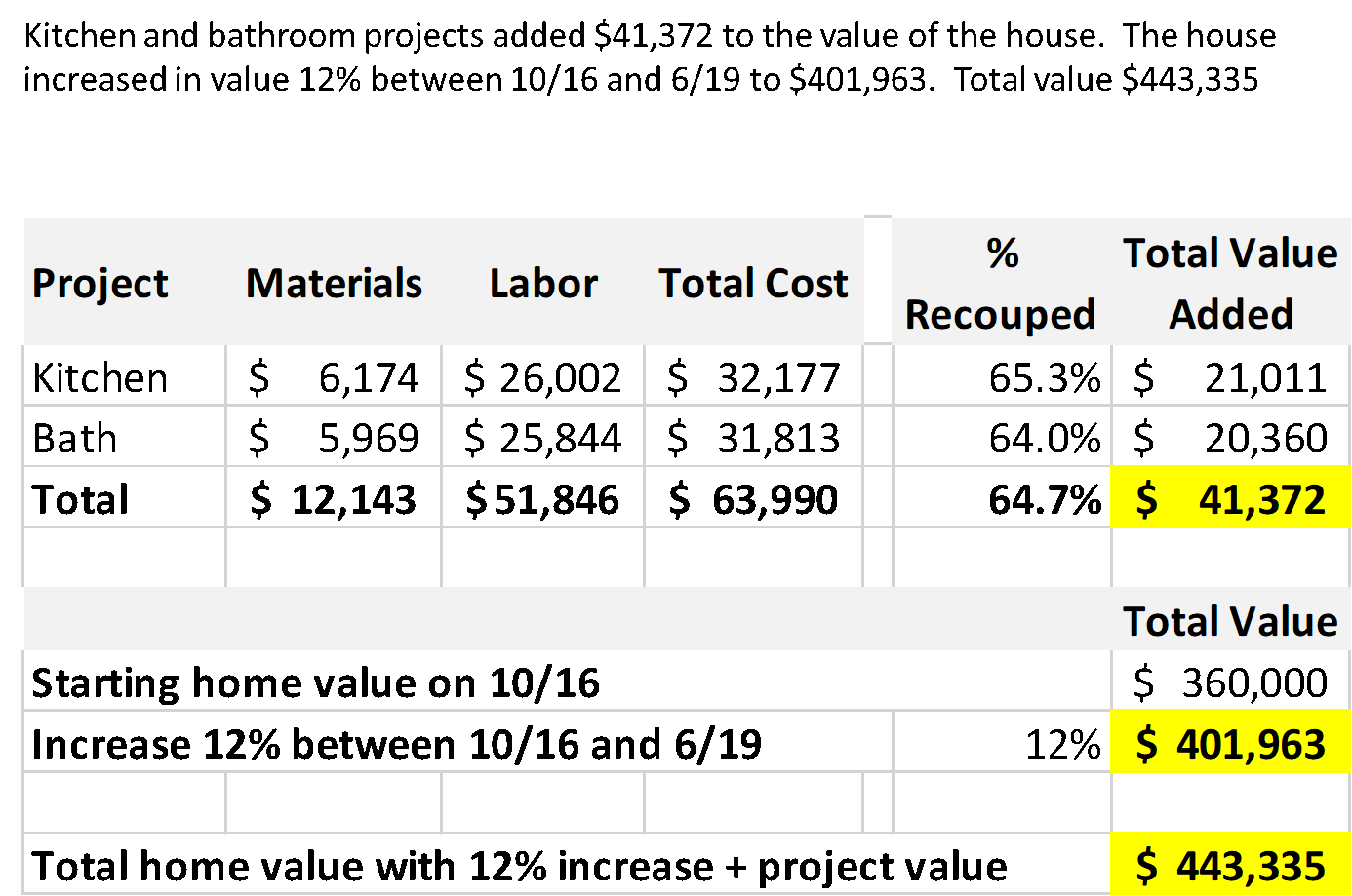

- Estimates for construction costs: A main reason appraised values go up is home improvements. If you had work done to your house that required a permit the city/state knows that the value of your home likely increased. And it wont miss an opportunity to charge more tax. To determine if their incrase was fair compare the increase in assessed value to the recoped value of your renovation costs. To determine the recopued value cost vs value (link) shows the percentage recoped for each upgrade. Example, if you spend 100,000 on a new bathroom you can assume that your home went up 60,000 (100,000 x 60%). If they took your assessment up more than that you have a case. The image below is an example of how you can illustrate a value increase.

- Property issues: Every house has issues and the tax authorities have no idea what those are. It’s important to tell them in detail when negotiating your case for a reduced appraised value. Take lots of photos. Let them know this will impact a potential buyer and will drive down the value

- Sales contract or closing statement: If you recently bought your home this is the easiest way to prove value. A house is only worth what someone is willing to pay, and a recent sale shows exactly what someone is willing to pay

- Appraisal: If you have an appraisal from a certified real estate appraiser this is a great way to prove home value. You can use this as a starting point for your negotiation and increase the appraised value based on your market conditions since the appraisal took place. A great tool to measure market conditions in your area is Zillow Home Value Index. This is a seasonally adjusted average value of homes in your area, and you can pick points in time to calculate how much home value increased/decreased since the appraisal